Understanding Fake Transfers: A Comprehensive Guide

What Are Fake Transfers?

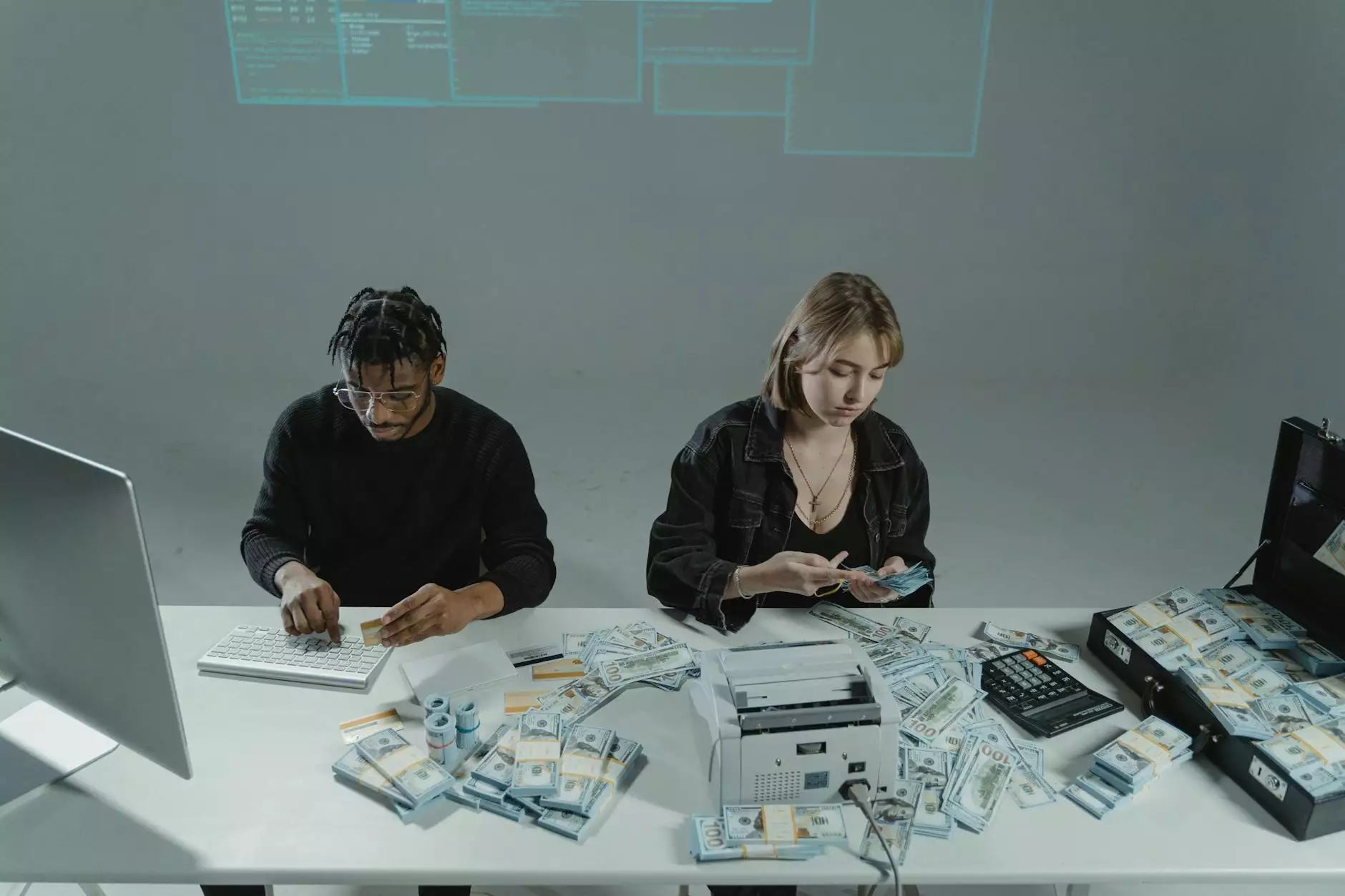

Fake transfers refer to fraudulent transactions that utilize counterfeit funds, like fake banknotes or fake money, which can lead to severe financial repercussions for businesses and individuals alike. This illicit practice is often employed by criminals looking to exploit unsuspecting victims or businesses that inadequately vet their payment methods.

The Rise of Fake Transfers in Today’s Economy

In the digital era, the ease of conducting financial transactions online has unfortunately led to the growth of fraudulent activities. Fake transfers can occur through various channels, including online banking, wire transfers, or even traditional checks that appear legitimate but are ultimately worthless. The proliferation of counterfeit money and fake banknotes accentuates this growing trend, posing a challenge for financial institutions and businesses globally.

How Do Fake Transfers Work?

Understanding how fake transfers operate is crucial for recognizing and preventing such schemes. Here are the common methods employed:

- Manipulating Digital Payment Systems: Criminals often use sophisticated software to manipulate online payment systems, creating the illusion that a transfer has been completed.

- Fake Checks: One of the most common forms of fake transfers involves counterfeit checks that look authentic but ultimately bounce.

- Phishing Schemes: Scammers frequently use phishing tactics to steal credentials, enabling them to create fake transfers from real accounts.

Employing these methods, fraudsters aim to deceive victims into believing transactions have been processed correctly, leaving them at a loss once the deception is uncovered.

The Legal and Financial Implications of Fake Transfers

Engaging in or falling prey to fake transfers can have profound consequences:

Legal Ramifications

Utilizing counterfeit money or participating in fake transfers can lead to serious legal troubles, including:

- Criminal Charges: Individuals caught using or distributing fake money can face felony charges, leading to severe fines and imprisonment.

- Civil Penalties: Victims of fraud can sue perpetrators for financial loss, leading to additional legal repercussions.

- Loss of Business Licenses: Businesses caught dealing in counterfeit money risk losing their operating licenses, tarnishing their reputation irrevocably.

Financial Consequences

The financial impact of fake transfers can be catastrophic, including:

- Immediate Loss of Funds: Businesses can experience immediate financial losses when they accept counterfeit funds.

- Bank Fees: Banks may charge fees for bounced checks or fraudulent transactions, compounding financial loss.

- Long-term Damage to Reputation: Businesses known for fraudulent transactions may struggle to regain customer trust.

Identifying Fake Money and Fake Transfers

Identifying counterfeit money is essential for avoiding fake transfers. Here are some tips:

- Check Security Features: Most legitimate banknotes have specific security features such as watermarks, color-shifting inks, and embedded security threads.

- Use UV Light: Many counterfeit bills lack the features that respond to ultraviolet light, revealing their fraudulent nature.

- Educate Employees: Training employees to identify fake money can help businesses reduce the likelihood of accepting counterfeit funds.

Preventing Fake Transfers in Your Business

To safeguard against fake transfers, businesses can implement several preventive measures:

- Enhance Verification Processes: Implement strict verification processes for all transactions, especially for large sums of money.

- Adopt Advanced Fraud Detection Software: Leverage technology that flags suspicious activities and alerts businesses to potential fraud.

- Regularly Audit Financial Transactions: Conduct regular audits of financial transactions to quickly identify irregularities.

- Stay Informed About Fraud Trends: Keeping up with evolving fraud techniques can help businesses remain vigilant and proactive.

Resources for Affected Businesses

In the unfortunate event that a business falls victim to fake transfers or receives counterfeit money, it’s crucial to know the appropriate steps:

- Contact Local Authorities: Reporting the incident to local law enforcement can help initiate an investigation.

- Notify Financial Institutions: Inform banks or payment processors immediately to mitigate financial loss.

- Consult Legal Advisors: Seeking legal counsel can guide businesses through potential civil suits or liabilities that may arise.

Conclusion: The Importance of Vigilance Against Fake Transfers

In a world where financial transactions are increasingly complex, understanding fake transfers and their implications is vital for businesses and individuals alike. Stakeholders must prioritize education, vigilance, and proactive measures to ensure they do not fall prey to the fraudulent activities ensnaring the modern economy. The importance of a robust approach to identifying and mitigating potential fake transfers cannot be overstated, and it is the responsibility of each business to safeguard its financial integrity.

By employing the strategies outlined in this article, businesses can create a safer financial environment, reduce the risk of falling victim to fraud, and ultimately thrive in a world where counterfeit money and fake transfers are ever-present threats.